There seems to be an insatiable appetite for Mergers and Acquisitions (M&A)now that the initial shock of COVID-19 has passed while economies attempt to return to pre-COVID-19 days. This can be seen as M&A activities in Singapore witnessed a surge in 2021, with deals surpassing US$175 Billion, more than 70% higher as compared to the previous year1. This is also aligned to Global M&A Markets, witnessing record valuations for strategic deals, achieving over $3.8 Trillion USD in value, up 47 per cent from the previous year2. Singapore’s government is also trying to get SMEs to ride the wave by expanding the Enterprise Financing Scheme (EFS)’s Merger and Acquisition loan programme to include domestic M&A activities3.

Not surprisingly, the increase in global and local M&A activities has also trickled down to Singapore’s Private Education Industry Sector where many deals were concluded and / or in the midst of being concluded. EduValue, together with EduValue Global (“EV Global”), is expected to close M&A deals for 4 Singapore Private Education Institutions (PEIs) in Q1 of 2022 alone. In this article, we would like to share the key reasons for these acquisitions and some of the key elements that make these acquisitions attractive for investors that are interested in the Singapore Private Education Industry Sector.

- With high barriers of entry due to tough compliance requirements for new PEI set-ups, acquisitions remain the fastest way for foreign education brands, foreign institutional / individual investors to enter this sector. Interestingly, out of the 4 M&A deals that is expected to be closed by EV Global this quarter, all 4 of the buyers are foreign based educational groups coming from Japan, Australia, India, and Vietnam.

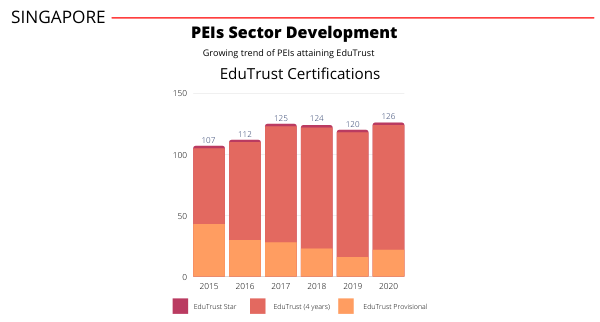

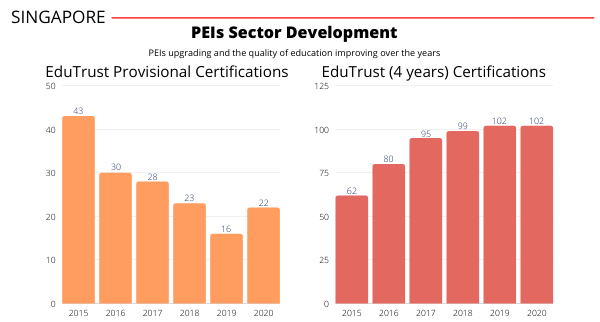

- Players are looking to enter the Sector immediately via M&As, where after the acquisition, they would be able to immediately bring in their programmes, from diploma to degrees, masters and PHDs for students from both local and international markets. They would be able to do so via the acquired PEI with the necessary licenses and accreditations (i.e., ERF and EduTrust).

- As compared to starting a new PEI from scratch, which can take up to 4-6 years if one intends to run degree programmes or target international students, the lowered risks and ability to enter the market immediately following an acquisition provides an extremely valuable proposition. Read our FAQs on the regulation requirements for EduTrust where more insights as to why EduTrust is needed for Singapore PEIs.

- With economies moving towards living with COVID-19 along with many issues happening in the western part of the world and Hongkong, Singapore is well placed to be an educational hub for Asia, especially in the South-East Asia Markets. Being one of the most developed economies for this region, coupled with it being known for education quality, having a presence in Singapore would allow educational brands to grow their presence in this region and globally.

- With a 4 Year EduTrust Certification, Singapore PEIs are also then able to “export” their Programmes internationally, partnering with various colleges and / or educational delivery centres, with international graduates being awarded a Singapore registered PEI Certificate. This could provide value especially to neighbouring countries in the region.

Being the market leader for Strategic M&A Services for the Singapore Private Education Industry, EV Global is well positioned to assist all stakeholders (i.e., both buyers and sellers) for this sector with regards to M&As and this include the following.

- Assisting both local and international investors and / or educational brands that are keen to set-up in Singapore via our M&A Services, including strategic advice and consulting for the acquisition roadmaps and related goals.

- Assisting Singapore PEIs in enhancing their portfolios and exit strategies (i.e., finding a suitable buyer and alignment of current portfolios to current set of buyer requirements.

- Due diligence with regards to ERF / EduTrust Certifications.

With the increase in M&A deals, including handling multiple transactions over the last 6 months, EV Global has enhanced our strategic capabilities in assisting both buyers and sellers. By partnering with EduValue, Singapore’s largest QA / Compliance Consulting Firm that specializes in Private Education, we are able to provide assurance to buyers on the many risks involved for both the ERF and EduTrust Certifications of the potential target. Do let us know if you would want a confidential session with our specialized M&A Team from EV Global and EduValue and we would love to set one up.

You can contact us via

a. our website at: www.eduvalue.com.sg/contact-us or

b. email us at support@eduvalue.com.sg

References

1 Michelle Zhu (2021). Investment banking fees in Singapore surge 34.4% to hit US$1b in 2021 to date, Banking & Finance – The Business Times,

2 Michelle Zhu (2022). M&A dealmakers optimistic for 2022 despite pain of record-high prices: Bain, Banking & Finance – The Business Times,

3 Ovais Subhani (2022). Budget 2022: Two new schemes to help promising large companies expand, The Straits Times,