The Singapore Training and Adult Education Sector is comprised of three pillars of Continuing Education and Training (CET), which are Private Training Organizations, Institutes of Higher Learning, and In-House Enterprises. Altogether, these three categories contain more than one thousand training organisations (SKillsfuture.SG, 2019). According to Skillsfuture.SG (2019), the sector employed approximately 20,000 Training and Adult Education professionals. Half of these professionals were Adult Educators, who were responsible for the design and delivery of training. The other half were Learning Managers, of which 94% were Professionals, Managers, Executives, and Technicians (PMETs), and 6% were non-PMETs. Learning Managers provided support for the delivery of quality training experiences.

Singapore’s dedication to education is demonstrated by the fact that the country’s students and universities consistently obtain the highest global rankings. However, education is not restricted to official institutions such as universities and technical institutes. Graduates will need to regularly reskill and upskill in order to remain competitive in the labour market, especially in a post-coronavirus world. Skills-building modalities are shifting as businesses prepare for hybrid workplace models. It is critical that our TAE experts continue to learn new skills and keep up with changing industry and workplace requirements.

Singapore’s market for adult learners is estimated at 500,000 learners a year

In 2015, the Singapore’s SkillsFuture initiative was started. Today, their strategic response is focused on the next bound of SkillsFuture directions which is aimed at increasing individual support, helping businesses on their path to skill development indicated Ong Tze-Ch’in, Chief Executive, SkillsFuture Singapore in the SSG Skills Demand For The Future Economy Report dated Dec 8, 2021 SkillsFuture.SG, 2021).

In 2020, an estimated 540,000 Singaporeans benefited from SkillsFuture Singapore-supported programmes, 40,000 more trainees than in 2019, and 14,000 businesses benefited (The Business Times, 2021). Ministry of Education, Mr Chan Chun Sing stated in a ChannelNewsAsia report said that the Singapore workforce must take responsibility for growing their own skills and expanding their knowledge. Mr Chan estimated that half a million adult workers need to go through upgrading every year since workers tend to change jobs every four to five years (Ang, 2022; Ng, 2022).

How big is the Singapore TAE and education market?

TAE training providers registered with Skillfuture.SG in Singapore offer a wide range of programmes and could be categorised into two major types namely, WSQ training providers and non-WSQ training providers. A WSQ training typical enjoyed government funding. Based on the Training and Adult Education Landscape in Singapore: Characteristics, Challenges and Policies report, most training providers are small-medium enterprises and it is estmated that about 64% had a yearly turn-over of less than $1 million and about 30% of training providers earned between $1 million and less than $10 million (Institute for Adult Learning, 2020).

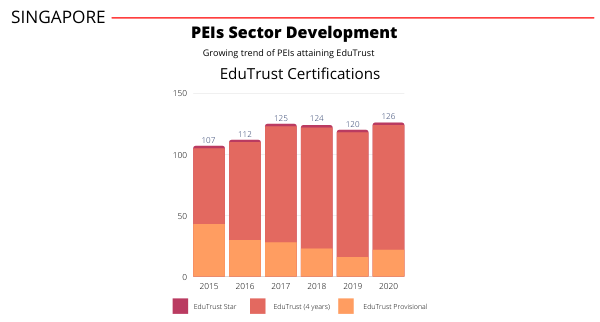

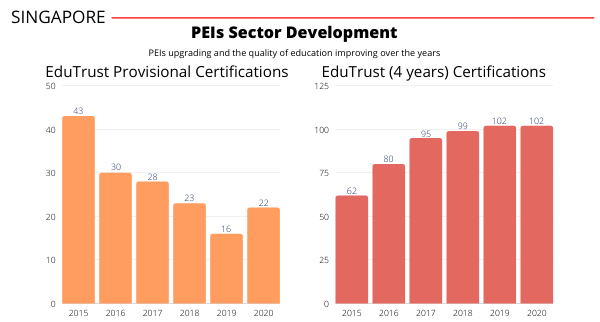

The total expenditure of the Singapore Ministry of Education in 2021 is approximately $13.62 billion, a $0.99 billion or 7.8% increase over the year 2020, with a provision of $0.87 billion made for SKillsFuture Singapore in 2021 to implement policies and schemes to support lifelong learning and skills development, as part of the SkillsFuture movement (Ministry of Education, 2021). According to the Ministry of Education, $0.48 billion of the total 2021 provision is for COVID-19-related programmes such as the SGUnited Skills (SGUS) Programme and the Enhanced Training Support Package Programme (ETSP) (2021). Furthermore, training providers may desire to enter the Private Education Institution (PEI) sector, which is expected to be worth approximately $3.1 billion in 2021 according to a 2021 Private Education Sector View update by the Committee of Private Education Singapore (CPE , 2022).

The Singapore government spends a quarter-million dollars on each child to prepare him for his first job, but what is critical is the learning after they leave school. By 2025, work-study programmes will be a mainstay pathway catering to 12% of each age cohort, up from 4% today, and the number of adult learners trained by Institute of Higher Learning has more than doubled from around 165,000 in 2018 to 345,000 in 2020 according to Minister of Education, Mr Chan Chun Sing (The Straits Times, 2022).

Training providers could also consider focusing on the E-Learning market. The Singapore E-Learning market was valued at US$ 792.97 million in 2019 and is expected to reach US$ 2,228.74 million by 2027. It is estimated to grow at a CAGR of 13.6% during 2020 – 2027 (The Insight Partners, Aug 2020).

What types of training providers will fare better?

The Singapore government is aggressively working to improve training providers’ services in order to professionalise and strengthen the TAE business. Training providers must be committed to assisting Singapore’s industrial development and ensuring the economic competitiveness of Singaporeans.

The four areas where training providers must be linked with the Singapore government’s skills plan are as follows (Ministry of Trade and Industry Singapore, 2022 (2)):

- Leverage emerging technology for effective learning

- Embrace workplace learning

- Changing employment responsibilities and skills of adult educators

It is crucial, then, that the TAE industry is of high quality and responsive, addressing the current and rising skills needs of businesses and individuals across all industries and assisting enterprises in enhancing their performance by upskilling and reskilling their workforce. In view, Skillsfuture is expecting training providers to be committed in focusing on three key thrusts of professionalism and competencies (The Ministry of Trade and, 2022 (1))

- Innovation – Training providers should reposition themselves by offering training that is strongly connected with business solutions in order to boost business performance and meet the skill requirements of the industries they serve.

- Jobs and Skills – Training providers and their staff are encourage to acquire skill mastery and increase their professional competencies.

- Productivity – Training providers are supported by Skillsfuture to enhance potential learners access to MySkillsFuture Portal information on training options and quality. Improve the operational efficiency of training providers by implementing training management solutions and centralised feedback gathering from trainees.

What programmes should training providers prioritise?

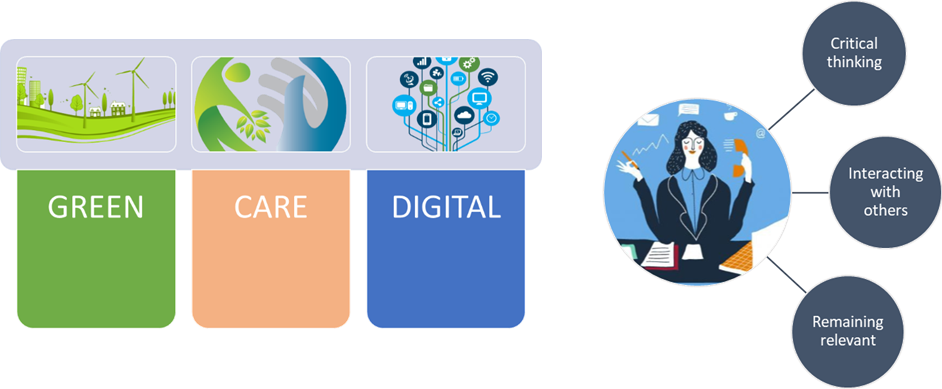

The SSG Skills Demand For The Future Economy Report has identified 20 “priority skills” clusters in the three sectors of Green, Care, and Digital fields, as well as 16 “critical core skills” in soft skills organised into three clusters: critical thinking, interacting with others, and remaining relevant for the Singapore economy’s future needs of sustainability and competitiveness (SkillsFuture.SG, 2021).

Training providers who could provide programmes within these skills clusters will have a higher success as it meets the vision of SkillsFuture Singapore “To build a high-quality and responsive Training and Adult Education (TAE) sector to support industry transformation and good employment outcomes for Singaporeans in the economy”.

- Education Technologies (EdTech) and related skills are powering the TAE business.

- There is increased recognition of the criticality of workplace learning, and the need for capabilities to organise the workplace for learning.

- Career/learning counselling and coaching-related skills have risen in significance and demand, to translate industry trends and business transformations to tangible actions that can be taken by individuals who want to enhance their workplace performance or prepare for career pivoting.

Adult learners’ profiles and requirements must be thoroughly understood by training providers.

According to studies, adults who are learning have a natural need to understand the justification for choosing a particular subject to study. One of the many responsibilities of training providers is to pique the interest of working adults in reskilling and upskilling by highlighting the significance of the knowledge being delivered to the trainees, or instilling in them a “need to know”. Trainers will need new abilities to help adult learners rapidly transform from dependent learners to self-directed learners. Adult learners with a strong sense of self-directedness and, in particular, a success orientation toward studying were more confident in their employability traits and felt particularly positive about their proactivity, career self-management, and career resilience (Botha, et al., 2015).

Adult learning, from a learning outcome standpoint, produces a competent and efficacious person, one who has mastered the knowledge and developed the abilities to act confidently in the world (Fenwick & Tennant, 2004). Therefore, adult educators need to access a wider range of learning theories to inform their instructional strategies, learning objectives, and evaluation approaches (Mukhalalati & Taylor, 2019).

Conclusion

The Singapore training and education market is evolving. The Singapore Government is taking a keen interest in the adult training sector, and given the market size and government funding allocations, as well as the need for workforce to have a deeper appreciation for newly acquired knowledge and abilities to meet the future needs of the economy, the market is moving in a positive direction for training providers who can meet the direction of training needs set out by the Singapore Government.

Working people are deemed ready to learn in a typical working environment when they have a need in their living circumstances to know something or be able to do something in order to carry out their tasks more successfully and with a higher level of satisfaction. When adults participate in a learning activity, they do it with a task-centered attitude toward learning (or problem-centered). Adult education programmes are more likely to succeed when they are organised around specific goals, obstacles, or life situations.

Training providers who are more adept at addressing these learning principles would be able to create stronger programmes, boosting demand for their courses to fill skill gaps, remaining competitive, and being acknowledged by SkillsFuture Singapore as a key player in Singapore’s development and progress.

References

Ang, H. M., 2022. Pace of acquiring skills and knowledge must intensify, continual learning will help people remain relevant: Chan Chun Sing, s.l.: ChannelNewsAsia.

Botha, J.-A., Coetzee, M. & Coetzee, M., 2015. Exploring adult learners’ self-directedness in relation to their employability attributes in open distance learning. Journal of Psychology in Africa, 25(1), pp. 65-72.

CPE , 2022. 2021 Private Education Sector View, s.l.: SkillsFuture Singapore .

Fenwick, T. & Tennant, M., 2004. Understanding Adult Learners. In: Dimensions of Adult Learning. 1st Edition ed. s.l.:Routledge, p. 19.

Institute for Adult Learning, 2020. Training and Adult Education landscape in Singapore: characteristics, challenges and policies, Singapore: Institute for Adult Learning.

Joo, G. S. et al., July 2022. JOBS-SKILLS QUARTERLY INSIGHTS, s.l.: SkillsFuture Singapore.

Ministry of Education, 2021. FY2021 EXPENDITURE ESTIMATES, s.l.: s.n.

Ministry of Trade and Industry Singapore, 2022 (2). Infograohics: The Education (Training and Adult Education), s.l.: SkillsFuture Singapore.

Mukhalalati, B. A. & Taylor, A., 2019. Adult Learning Theories in Context: A Quick Guide for Healthcare Professional Educators. Journal of Medical Education and Curricular Development, 6(1), pp. 1-10.

Ng, W. K., 2022. SkillsFuture funding framework to focus on courses relevant to industry, s.l.: The Straits Times.

SKillsfuture.SG, 2019. The Training And Adult Education Sector At A Glance, s.l.: Singapore Government .

SkillsFuture.SG, 2021. Skills Demand for the Future Economy, s.l.: s.n.

The Business Times, 2021. Re-imagining adult learning for the workforce of tomorrow, today, s.l.: SPH MEDIA DIGITAL NEWS.

The Insight Partners, Aug 2020. Singapore E-Learning Market to Grow at a CAGR of 13.6% to reach US$ 2,228.74 Million from 2020 to 2027, s.l.: The Insight Partners.

The Ministry of Trade and, 2022 (1). MEDIA FACTSHEET ON THE EDUCATION (TRAINING AND ADULT EDUCATION), s.l.: Skillsfuture Singapore.

The Straits Times, 2022. Budget debate: More places for adult learners on the cards, new transition programme for mid-career workers, s.l.: SPH.

Written By Alan Go, Lead Researcher, EV Academy